Texas was a warning. Australia needs to rethink the design of its electricity market

- Written by The Conversation

Australia’s electricity market is unsustainable. Texas shows us why.

A week ago Texas experienced a bout of severe weather as arctic air reached deep into the state, driving temperature down to levels that had not been experienced for 30 years. The full human toll is yet to be counted, but 20 deaths have so far been associated with motor accidents, from fires lit for warmth and from carbon-monoxide poisoning after residents used their cars to try to warm their homes.

At the peak, 4.5 million people were without power in many cases for extended periods. The Texas Poison Centre received 450 calls about carbon monoxide poisoning.

A colleague in Austin, Texas, an expert in power markets, endured 59 hours without electricity during which period the temperature in his well-insulated home dropped to six degrees Celsius.

The main explanation was that gas pipelines froze, denying gas supply to Texas’s dominant gas-fired generators. One of the two Texas nuclear power stations also failed and the blades of some of the wind farms not equipped with de-icing equipment iced over.

Remarkable as the physical story was, the financial story is even more amazing.

For nearly four days the Texas wholesale electricity price reached its maximum cap of US$9,000 per megawatt hour, about 300 times the level it would otherwise have been expected to be.

Prices 300 times higher

Whereas the typical Texan household could expect to spend about $2 per day on electricity, if that household was not cut off during the freeze and was exposed to the real-time market, it would have been charged around $600 per day.

Many energy economists and public interest advocates have long yearned for customers to be exposed to the varying price of electricity in wholesale markets.

They have been saying it would make demand more responsive to supply and reduce the need for wholesale prices to ever climb particularly high.

But it is the users of a Texas start-up, Griddy, that does exactly that, that have been hit the hardest.

Households with power unable to afford it

These customers would have signed up to Griddy expecting to have to occasionally cut their demand for an hour or two to avoid peak prices and so reduce their bills.

As the storm approached, Griddy encouraged them to leave for safe harbour with other retailers that offered fixed price deals, but many could not find retailers to take them.

The physical storm has passed, but the financial storm has only just started.

There are rising concerns of a full-blown credit crisis in the Texas power market sending retailers and customers bankrupt. The Governor has ordered an inquiry.

Australia has the same system

It is difficult to know where to start with a problem as big and complex as this, but reaching for parallels is as good a place as any.

The closest parallel to the market for electricity is probably the market for petrol.

Australian motorists get upset if the price of petrol climbs by 10% in the space of a week. But in Texas wholesale electricity prices climbed by almost 30,000% during the storm and stayed at the US$9000 per megawatt hour ceiling for four days.

Read more: Texas blackouts show why energy should be a universal right

The theory on which the market rests is that the possibility of an enormous price spike is needed to ensure supply. It makes it worth someone’s while to do something expensive to get more electricity into the system.

It’s the same theory on which Australia’s market rests. Evidently, there’s room for improvement.

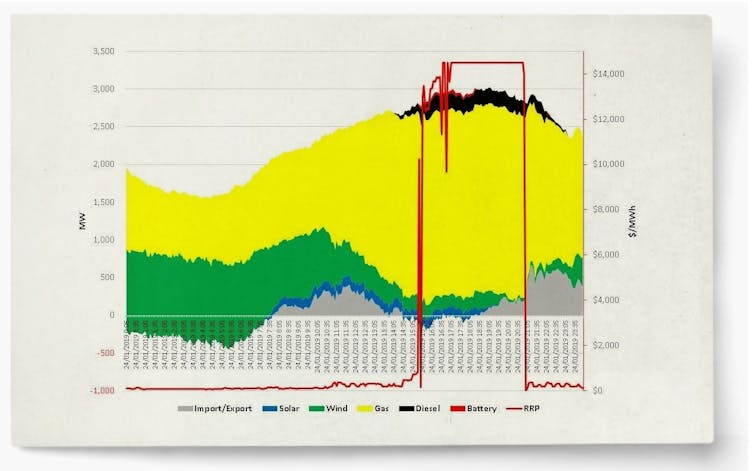

Australia’s ceiling is A$14,500 per megawatt hour. It has been reached only briefly (usually for no more than a few hours) and rarely (usually only a few times a year).

An Australian price spike, January 24, 2019.

Australian Energy Council

An Australian price spike, January 24, 2019.

Australian Energy Council

Australia’s market has the additional protection of caps on cumulative prices, but in the event of a Texas-style catastrophe, it could still send retailers broke.

The smallest retailers - often the lifeblood of retail competition - are most at risk.

Read more: The Texas deep freeze left the state in crisis. Here are 3 lessons for Australia

The proliferation of regulatory obligations to bolster reliable supply is testament to policy makers’ growing lack of confidence that price spikes are the way to do it.

It’s time for energy economists to reconsider what for many has been an article of faith — that prices are the right solution for everything.